Energy Storage Tax Credit: Before and After the Inflation Reduction Act

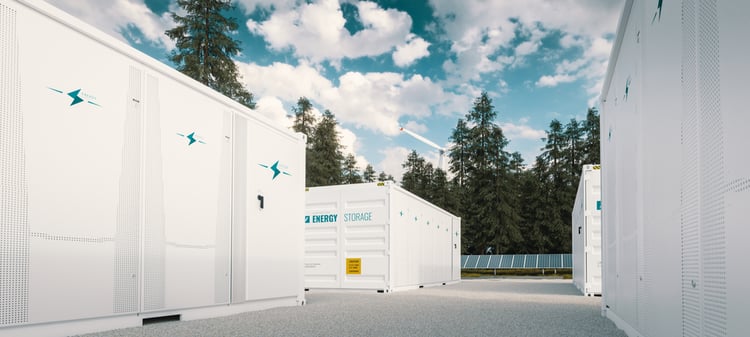

The Inflation Reduction Act (IRA) not only extended the 30% federal tax credit for solar panels. Energy storage systems now qualify more easily than before, and this means that a much larger number of battery installations will get the 30% tax credit.

Before the IRA, only batteries charged by solar panels were eligible for the Investment Tax Credit (ITC), which greatly limited their usefulness. Solar generation is not always available to charge batteries, and stand-alone energy storage has promising applications. Having a dedicated tax credit for energy storage is also useful for electricity consumers who cannot install solar panels for any reason.

Get a solar PV + energy storage design for your next building project.

For example, if you own an apartment with shared roof areas, installing solar panels is not normally an option. However, a battery can be useful as a backup power source, and you can also use it to avoid peak kWh prices (in case you’re charged time-of-use tariffs).

Here we will discuss how the federal tax credit for energy storage changed with the Inflation Reduction Act, comparing the requirements for residential and commercial installations. Keep in mind that the tax credit for stand-alone batteries becomes available until 2023, and the solar charging requirement still applies as of 2022, for both residential and business-owned systems.

Federal Tax Credit for Residential Energy Storage

Getting a federal tax credit for a home battery was already possible before the IRA, but there was a major restriction: Only batteries fully charged by onsite solar panels were eligible. This means your battery had to be designed to never consume a single kilowatt-hour from the grid, and this brings several issues:

- You cannot charge the battery at night, and charging is also limited during cloudy days.

- You cannot take advantage of a time-of-use tariff - charging the battery with cheap off-peak electricity, and reducing your consumption of peak-hour electricity.

The previous tax credit was also unavailable for homeowners who wanted to install only a battery system, since electricity comes from the grid. Even if you selected an electricity plan with 100% renewable energy content, or you joined a local community solar project, the battery would still not qualify for the tax credit. In other words, you could not make a battery eligible for the old tax credit by using off-site solar power.

Thanks to the IRA, the 30% federal tax credit is available for all home energy storage systems with a capacity of at least 3 kWh. The electricity source used for charging is no longer a limitation. The following table compares the tax credit conditions before and after the Act:

| Home Battery Tax Credit Before IRA |

Home Battery Tax Credit After IRA |

| -26% in 2022, 22% in 2023, 0% in 2024. -Only available for battery systems charged with onsite solar power systems. |

-30% in 2023-2032, 26% in 2033, 22% in 2034. -Available for home batteries with a capacity of at least 3 kWh, regardless of energy source. |

Federal Tax Credit for Commercial Energy Storage

Commercial battery systems were in a similar situation before the IRA, but their requirements were slightly less demanding. Residential battery systems were subject to a 100% solar charging requirement, but commercial battery systems only had a 75% requirement. This means that up to 25% of their charge could come from other sources.

However, a business owned battery system would only qualify for the full tax credit if 100% of the charge came from solar panels. Otherwise, the tax credit would be adjusted according to the solar charging percentage. For example, a battery system meeting the minimum 75% charging requirement would not get the 26% tax credit. This energy storage system would only be eligible for a 19.5% tax credit (75% of the maximum value).

The IRA also removes the solar charging requirement for business-owned battery systems, only establishing a minimum system capacity of 5 kWh. This is slightly above the 3 kWh requirement for residential batteries.

| Business Battery Tax Credit Before IRA |

Home Battery Tax Credit After IRA |

| -26% in 2022, 22% in 2023, 10% in 2024. -Only available for battery systems getting at least 75% charge from onsite solar power. -Federal tax credit adjusted according to solar charging percentage. |

-30% in 2023-2033, 22.5% in 2034, 15% in 2035, 0% in 2036. -Available for business-owned battery systems with a capacity of 5 kWh or higher, regardless of energy source. |

Business owners must be aware of one additional requirement, which applies for installations with a power output of one megawatt or above. The base tax credit is only 6% in this case, and owners must meet certain labor requirements related to prevailing wages and apprenticeship to get the full 30% tax credit.

Michael Tobias

Michael Tobias, the Founding Principal of NY Engineers, currently leads a team of 150+ MEP/FP engineers and has led over 4,000 projects in the US

Join 15,000+ Fellow Architects and Contractors

Get expert engineering tips straight to your inbox. Subscribe to the NY Engineers Blog below.